i saw this in my inbox a few days ago, but thought i might as well post this again. flight centre is offering $30 off any canadian airfare (round trip, some conditions apply). this must be booked in store by july 7, 2013. you need to print the e-mail out and bring it in with you to the store. the webpage that is equivalent to the actual e-mail is here, so that you don't have to sign up for it if you don't want to.

flight centre retail locations aren't supposed to charge booking fees on pure domestic airfares. these airfares are exactly the same as what air canada and westjet charge -- they pretty much book it on their website in front of you. they will charge a high booking fee (~$65 depending on location) on us/international fares. if you have to make changes, they will charge an additional $50 on top of whatever the airline charges, even for domestic airfares. so the rule of thumb: this is a great coupon if you're going to book domestic travel only and it is very unlikely that your travel plans will change.

why pay the full amount to air canada / westjet when you can get the exact same thing for $30 less?

as a separate note, view from the wing notes that american airlines is trying to promote its award map. if you register for their sweepstakes, and book a reward flight by july 24/13 between sept 4 and nov 20/13, then you'll receive a 2,500 point rebate. partner flights are eligible but only if you can book online. the registration link is here.(remember that intra-island flights on partner airline hawaiian airlines is just 5,000 points one way, and is also eligible for this discount!)

trying to figure out my way around points, status, and making travel that much easier.

Sunday 30 June 2013

Saturday 29 June 2013

aeroplan distinction launch bonus, and more clarification.

distinction launch bonus

taken from this flyertalk thread, aeroplan is now adding a launch bonus for their distinction program (i blogged about the distinction program itself here).

between now and the end of the year, if you earn dBlack (50k) or dDiamond (100k), and if you hold a valid aeroplan affiliated credit card, you will get either a bonus of 10k (dBlack) or 15k (dDiamond) aeroplan points in 2014. these points also further count towards your status in the distinction program for 2015.

it would make sense that for anyone who holds superelite, altitude 75k, 50k, or even 35k to sign up. they're practically guaranteed to get this bonus provided that they have an aeroplan affiliated credit card. if one did not already, then the cheapest one you can get is the american express aeroplan plus card, first year waived, annual fee of 20$ a year afterwards. of course, CIBC has the first year free promos for their higher end cards happening all the time as well.

this doesn't make sense right now for me, however. my yearly credit card spend would net me 35k points, but i only have half a year to make up that spend. i need to bank all of my flight miles to asiana. so i will have to pass on this offer. not that i won't register, of course. because you never know.

more details about the distinction program

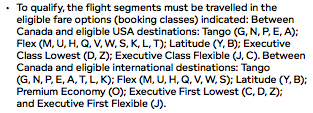

just to add on more details to what counts as qualifying miles, sign up bonuses for credit cards and bonus miles earned from your altitude status do not count:

and yesterday, i was raving about how great the getaway bonus was ... but now i take that back. it's not that special given that it's only applicable between canada and us/international. and it also requires a saturday night stay. but i suppose in the end, an extra 500-1500 miles is still better than nothing. i was really hoping it would be good for domestic flights so that it would compete a little bit more with westjet.

taken from this flyertalk thread, aeroplan is now adding a launch bonus for their distinction program (i blogged about the distinction program itself here).

between now and the end of the year, if you earn dBlack (50k) or dDiamond (100k), and if you hold a valid aeroplan affiliated credit card, you will get either a bonus of 10k (dBlack) or 15k (dDiamond) aeroplan points in 2014. these points also further count towards your status in the distinction program for 2015.

it would make sense that for anyone who holds superelite, altitude 75k, 50k, or even 35k to sign up. they're practically guaranteed to get this bonus provided that they have an aeroplan affiliated credit card. if one did not already, then the cheapest one you can get is the american express aeroplan plus card, first year waived, annual fee of 20$ a year afterwards. of course, CIBC has the first year free promos for their higher end cards happening all the time as well.

this doesn't make sense right now for me, however. my yearly credit card spend would net me 35k points, but i only have half a year to make up that spend. i need to bank all of my flight miles to asiana. so i will have to pass on this offer. not that i won't register, of course. because you never know.

more details about the distinction program

just to add on more details to what counts as qualifying miles, sign up bonuses for credit cards and bonus miles earned from your altitude status do not count:

and yesterday, i was raving about how great the getaway bonus was ... but now i take that back. it's not that special given that it's only applicable between canada and us/international. and it also requires a saturday night stay. but i suppose in the end, an extra 500-1500 miles is still better than nothing. i was really hoping it would be good for domestic flights so that it would compete a little bit more with westjet.

Friday 28 June 2013

updates: petro-canada pivot visa, pointshoud booking bonuses, and expedia's best price guarantee

1) when i posted about the petro-canada pivot visa card, to do straight withdrawals, i factored in a $1.50 fee that the atm would charge. i was under the assumption that most atms would not a reader had pointed out that not all atms charged that fee. while in edmonton, i found a credit union atm that did not. i am very, very encouraged. sadly, that credit union is only in alberta ... but it makes me want to stick my prepaid visa into any machine i can find. so for every $250 cycle, it is possible to get a bonus $5 back.

2) i had an e-mail sitting in my inbox for about a week now from pointshound. until the end of the month, you can get an additional 500 bonus points (to the airline of your choice, it seems) for every new trip booking. a trip is defined in the fine print as only one booking in a city per 7 day period (i.e., booking two nights at different hotels in seattle does not count). i booked my seattle hotel using their double dip feature. normally, i would refund it all and then rebook for the bonus, except that the price of the actual hotel has increased ...

3) from hack my trip, i learned that you have to add another step to utilize expedia's best price guarantee. they changed the wording with their new expedia rewards program. you can only get the $50 travel voucher now if you are a member of the expedia rewards program. but really, it's free to join, and you get 1-2% return on your hotel purchases. it's just an extra one-time step.

2) i had an e-mail sitting in my inbox for about a week now from pointshound. until the end of the month, you can get an additional 500 bonus points (to the airline of your choice, it seems) for every new trip booking. a trip is defined in the fine print as only one booking in a city per 7 day period (i.e., booking two nights at different hotels in seattle does not count). i booked my seattle hotel using their double dip feature. normally, i would refund it all and then rebook for the bonus, except that the price of the actual hotel has increased ...

3) from hack my trip, i learned that you have to add another step to utilize expedia's best price guarantee. they changed the wording with their new expedia rewards program. you can only get the $50 travel voucher now if you are a member of the expedia rewards program. but really, it's free to join, and you get 1-2% return on your hotel purchases. it's just an extra one-time step.

Thursday 27 June 2013

aeroplan adds "distinction" to its program, and TD may become aeroplan's credit card partner

so lots of news is happening in the aeroplan program. aeroplan is the spun off frequent flyer program for air canada, although to make things just that much more difficult, they are considered separate companies. their mutual contract runs until 2020, after which case, they can re-negotiate their terms or even part ways completely.

so it's with that in mind that i think aeroplan is adding a parallel status program called "distinction". there's some buzz on flyertalk about this new status program. instead of flight miles (as per air canada's altitude program), they have different tiers based on total earnings in a year from all coalition partners. it is unclear which partners count as coalition partners, although i'm sure it includes things like credit card spending.

what is probably the most important perk of this status is the air canada getaway bonus. receiving an extra 500-1500 points per eligible roundtrip flight finally puts air canada closer to par with westjet. remember that with westjet, you get 100% non-status miles on aadvantage, whereas previously, you would only get 25% non-status miles on air canada with aeroplan. but now a roundtrip YVR-YYC, if eligible, will give you 25% non status in addition to 500 bonus points for a total of roughly 712 miles roundtrip if you were a dSilver member (compared to westjet providing 852 aadvantage miles).

other major changes:

TD vs. CIBC for credit card partners

on an unrelated note from distinction, aeroplan and CIBC have been trying to renegotiate their current contract that is set to expire at the end of this year. CIBC had threatened to change things up if there were no significant concessions made by aeroplan. however, in a news release today, it looks like TD has put in a potential agreement with aeroplan. therefore, unless CIBC is willing to match, aeroplan may agree to partner with TD instead. from the news release, TD is willing to pay 15% more per mile, and a 100M upfront fee, as well as up to 400M to jointly market the card. TD really wants to play with aeroplan.

as with all new cards, i'm hoping for improvements above and beyond what is currently already offered. large sign up bonuses? baggage fee waivers? comprehensive and complimentary insurance packages (that exist with TD's existing credit cards)? mileage multipliers for gas/grocery/dining/entertainment (as per scotia bank's gold amex)? possibilities are endless.

so it's with that in mind that i think aeroplan is adding a parallel status program called "distinction". there's some buzz on flyertalk about this new status program. instead of flight miles (as per air canada's altitude program), they have different tiers based on total earnings in a year from all coalition partners. it is unclear which partners count as coalition partners, although i'm sure it includes things like credit card spending.

- dSilver = 25,000 miles across all coalition partners in a calendar year

- dBlack = 50,000 miles across all coalition partners in a calendar year

- dDiamond = 100,000 miles across all coalition partners in a calendar year

what is probably the most important perk of this status is the air canada getaway bonus. receiving an extra 500-1500 points per eligible roundtrip flight finally puts air canada closer to par with westjet. remember that with westjet, you get 100% non-status miles on aadvantage, whereas previously, you would only get 25% non-status miles on air canada with aeroplan. but now a roundtrip YVR-YYC, if eligible, will give you 25% non status in addition to 500 bonus points for a total of roughly 712 miles roundtrip if you were a dSilver member (compared to westjet providing 852 aadvantage miles).

other major changes:

- replacing classic+ flights with "market fare" flights

- classic+ flights are based on the actual fare of the flight. using an unknown conversion rate, a certain amount of aeroplan points will be needed to redeem them. they are guaranteed to be at least 15% higher than classic rewards, although more is generally the norm (e.g., 800,000 points to fly to LHR in business ... plus taxes). they are now renaming it to "market fare" flights. in the benefits, when they say "up to 20% off" for dSilver members, it doesn't really mean anything to me.

- one way awards

- a big development is that one-way awards are now priced at half of round trip awards, which makes sense. it used to be 70% of a round trip price, but finally, that has changed. this is a great thing for which aeroplan should be given credit for.

- increase in classic rewards pricing

- they had just increased the prices of major awards a few years back, and they're doing it again. in the end, i suppose this makes up for the 50% one-way award change above. back when i first started with aeroplan back in about 1996, canada to asia (all of it) was 75,000 points in economy and 100,000 points in business. this was an almost free ticket -- no fuel surcharges to pay. now, with this increase, going to "asia 2"is 155,000 points -- an increase of over 50%. oh, and i forgot about the fuel surcharges.

- removal of the 7-year expiration policy

- while the 12-month expiration policy still holds (i.e., accounts with no activity in any 12-month period will be cancelled with all miles forfeited), not being forced to spend all the miles within that 7-year period is a nice touch. not that the value of those miles will stay constant, but at least you won't lose them due to time alone.

TD vs. CIBC for credit card partners

on an unrelated note from distinction, aeroplan and CIBC have been trying to renegotiate their current contract that is set to expire at the end of this year. CIBC had threatened to change things up if there were no significant concessions made by aeroplan. however, in a news release today, it looks like TD has put in a potential agreement with aeroplan. therefore, unless CIBC is willing to match, aeroplan may agree to partner with TD instead. from the news release, TD is willing to pay 15% more per mile, and a 100M upfront fee, as well as up to 400M to jointly market the card. TD really wants to play with aeroplan.

as with all new cards, i'm hoping for improvements above and beyond what is currently already offered. large sign up bonuses? baggage fee waivers? comprehensive and complimentary insurance packages (that exist with TD's existing credit cards)? mileage multipliers for gas/grocery/dining/entertainment (as per scotia bank's gold amex)? possibilities are endless.

Monday 24 June 2013

an edmonton roadtrip -- three hotels to choose from ... i hope i made the right choice

i'm making a roadtrip to edmonton today. my goal is to stay in the downtown region as that's where friends are normally staying. so here are my three choices:

1) days inn edmonton downtown: close to my friends' places and their work, free internet, free parking ($10 value). bookable on hotels.com and paying in canadian funds. total hotel cost: $130. big crumbs offers a 4.55% rebate, and hotels.com's hotelrewards gives back 10%. it's a days inn ... i'm not looking for something fancy. i've stayed there before, can attest to its general cleanliness, and its no-frills kind of feel.

2) holiday inn express edmonton downtown: two-three blocks further from my friends' location, parking is an extra $10. free breakfast is included. i have gold status with the intercontinental hotel group, not that it gives any additional value. they were booked solid until yesterday, when probably due to weather and flooding problems in southern alberta, cancellations happened. i would never pay $180 + tax for a downtown hotel in edmonton of all places. to be fair, in most places, really. but they had a nice points proposition:

the maximum amount that i would be willing to pay at most for a hotel in that area would be around $150. the days inn satisfies that requirement. however, for an equivalent hotel, i could get it for 15,000 priority club points (roughly $1,500 in hotel spending). this is their lowest tier of spending. this gives an approximate value of $0.01 per point.

you can buy points for this reservation: 10,000 points for 70$, or 0.7 cents per point, no taxes added. (keep this in mind when you're being offered a chance to buy points -- points should never be sold at more than 0.7c per point!). the alternative calculation is to say that for a hotel that I would normally pay $150 for, i can get it for $70 and 5,000 points. so that's an 80$ savings in exchange for 5,000 points. that means that each of your points is worth $0.016.

note that with reward bookings (prior to july 1, 2013), there is no stay credits or point earning potentials.

3) four points by sheraton south. this hotel is located 5 miles away from downtown, offers free parking, and no breakfast. booking on the spg mobile app would yield a 500 point bonus and double starpoints. it would also yield another stay towards my quest for spg status. but it is 5 miles away!

in the end, i was cutting it close to the refund deadline time on hotels.com, and i thought that if i had to walk towards my friends' place, i'd rather be walking two blocks less. so laziness prevented me from booking a potentially great value for my 15,000 priority club points. there will be other opportunities in the future, i'm sure.

1) days inn edmonton downtown: close to my friends' places and their work, free internet, free parking ($10 value). bookable on hotels.com and paying in canadian funds. total hotel cost: $130. big crumbs offers a 4.55% rebate, and hotels.com's hotelrewards gives back 10%. it's a days inn ... i'm not looking for something fancy. i've stayed there before, can attest to its general cleanliness, and its no-frills kind of feel.

2) holiday inn express edmonton downtown: two-three blocks further from my friends' location, parking is an extra $10. free breakfast is included. i have gold status with the intercontinental hotel group, not that it gives any additional value. they were booked solid until yesterday, when probably due to weather and flooding problems in southern alberta, cancellations happened. i would never pay $180 + tax for a downtown hotel in edmonton of all places. to be fair, in most places, really. but they had a nice points proposition:

the maximum amount that i would be willing to pay at most for a hotel in that area would be around $150. the days inn satisfies that requirement. however, for an equivalent hotel, i could get it for 15,000 priority club points (roughly $1,500 in hotel spending). this is their lowest tier of spending. this gives an approximate value of $0.01 per point.

you can buy points for this reservation: 10,000 points for 70$, or 0.7 cents per point, no taxes added. (keep this in mind when you're being offered a chance to buy points -- points should never be sold at more than 0.7c per point!). the alternative calculation is to say that for a hotel that I would normally pay $150 for, i can get it for $70 and 5,000 points. so that's an 80$ savings in exchange for 5,000 points. that means that each of your points is worth $0.016.

note that with reward bookings (prior to july 1, 2013), there is no stay credits or point earning potentials.

3) four points by sheraton south. this hotel is located 5 miles away from downtown, offers free parking, and no breakfast. booking on the spg mobile app would yield a 500 point bonus and double starpoints. it would also yield another stay towards my quest for spg status. but it is 5 miles away!

in the end, i was cutting it close to the refund deadline time on hotels.com, and i thought that if i had to walk towards my friends' place, i'd rather be walking two blocks less. so laziness prevented me from booking a potentially great value for my 15,000 priority club points. there will be other opportunities in the future, i'm sure.

Sunday 23 June 2013

shopper's drug mart $10 off of $40 june 22-28

in the realm of points and things, i came across shopper's drug mart's $10 off of $40 (as found on smartcanucks). it's good from jun 22-28. normally, their prices aren't that competitive, unless they have deals like this. they have their own shopping program, shopper's optimum, which may be worth mentioning to help bring costs down. their base program is as such:

however, i recently started playing around with my scotia bank gold amex card. it gives 4% return on gas, grocery, dining, and entertainment. drug stores are not a part of that higher earning. so that's why you buy shoppers' gift cards from petro-canada. not only do you get the 4% return, but you also get 20 petro-points per dollar (which i kind of hinted about its potential and versatility here -- see the portion on the sears' mastercard). 20 petro-points is equivalent to a minimum of 2% back in travel, or 2 cathay pacific asia miles, which is worth anywhere from 2-5c each. furthermore, purchases made by gift card also earn shoppers optimum points. so the lesson: you should never pay directly at shoppers drug mart when you can buy a gift card first from somewhere else.

so if you combine the petro-points and the additional bonus that you get from your credit card by shopping at a gas station (2% above your regular no-fee cash back card), then that's an additional 4-12% off. and add that to this $10 off $40 coupon, which is essentially 25% off, shopper's may be quite competitive after all.

- 10 points per $ spent

- one redeems in tiers, such that the more you redeem, the higher the return is.

- 8,000 pts = $10 rebate (i.e., spent $800 for $10 back, or a 1.25% return)

- 95,000 pts = $170 rebate (i.e., spend $9,500, get $170 back, or a 1.79% return)

- there are almost weekly bonuses, whereby spending a certain amount gets you either a set large amount of points, or a high points multiplier. other weeks, they increase the value of your points, such that redeeming points will give you higher rewards (e.g., spend 95,000 points, get $195 back)

- during a 20x the points event, your potential return can be as high as 35% (1.79% x 20)

- supplies for my braces -- i found that nowhere else would sell threading floss and dental wax

- toothbrushes and toothpaste -- usually colgate products (85mL toothpaste, soft single toothbrushes) would be sold for $1 each. i would generally combine this with the 20x the points events ... meaning i would be coming out with a lot of toothbrushes and boxes of toothpaste

however, i recently started playing around with my scotia bank gold amex card. it gives 4% return on gas, grocery, dining, and entertainment. drug stores are not a part of that higher earning. so that's why you buy shoppers' gift cards from petro-canada. not only do you get the 4% return, but you also get 20 petro-points per dollar (which i kind of hinted about its potential and versatility here -- see the portion on the sears' mastercard). 20 petro-points is equivalent to a minimum of 2% back in travel, or 2 cathay pacific asia miles, which is worth anywhere from 2-5c each. furthermore, purchases made by gift card also earn shoppers optimum points. so the lesson: you should never pay directly at shoppers drug mart when you can buy a gift card first from somewhere else.

so if you combine the petro-points and the additional bonus that you get from your credit card by shopping at a gas station (2% above your regular no-fee cash back card), then that's an additional 4-12% off. and add that to this $10 off $40 coupon, which is essentially 25% off, shopper's may be quite competitive after all.

Saturday 22 June 2013

i got my brandsaver coupons! -- june 2013 edition

in the mail the other day, i received my brandsaver coupons. ever since moving into an apartment and no longer getting any of those penny-saver leaflets, i feel like i'm missing out on great deals. and so those coupons in the mail were a great source of joy. seriously, they are.

they're easy to cut out, easy to redeem, and stackable with checkout 51. simply register here and every few months, a new batch of coupons become available to order. they're very similar to the coupons i saw in my parents' leaflets the other day, which doesn't make me feel quite as bad. save.ca and websaver.ca are similar sites, although not linked solely to a particular company. the number of coupons they have are not quite as large.

brandsaver will, from time to time, offer free samples, which is also so much fun to receive in the mail. they keep giving me these tide pods, and i keep using them ...

in my coupon booklet, i received:

they're easy to cut out, easy to redeem, and stackable with checkout 51. simply register here and every few months, a new batch of coupons become available to order. they're very similar to the coupons i saw in my parents' leaflets the other day, which doesn't make me feel quite as bad. save.ca and websaver.ca are similar sites, although not linked solely to a particular company. the number of coupons they have are not quite as large.

brandsaver will, from time to time, offer free samples, which is also so much fun to receive in the mail. they keep giving me these tide pods, and i keep using them ...

in my coupon booklet, i received:

- 50c off one charmin toilet paper product

- $4.50 off any crest pro-health toothpaste/crest 3d white toothpaste/crest 3d whitening rinse + oral-b toothbrush

- $2.50 off any crest pro-health toothpaste/3d white toothpaste + crest 3d whitening rinse

- $8.00 off any 3d whitestrips

- free gillette razor with purchase of gillette cartridge pack

- $1.00 off any two pantene products

- $1.00 off any two head and shoulders products

- $3.00 off any tide pods + downy unstopables

- $1.00 off any tide pods

- $1.00 off any bounce dryer bar

- 50c off any bounty paper towel product

- $1.25 off any two different bounty or charmin products

- $1.00 off any cascade actionpacs product

- $1.00 off any two dawn products

- $1.00 off any coppertop duracelle batteries

- $1.00 off any febreze, swiffer, mr. clean or gain laundry products

- $2.50 off any two febreze, swiffer, mr. clean or gain laundry products

- $1.00 off any febreze product

- $3.00 off any two febreze products

Friday 21 June 2013

it's raining in calgary -- vacation edition jun 2013

i have 4 weeks of vacation a year, on top of other random things. our work year runs from jul-jun, and so if you don't use your vacation time by the end of june, you lose it. and i do not waste my vacation time. so i decided to go to calgary to see friends and family. it's not quite a mattress run as i'm staying at chateau mom and dad, and i'm pretty sure that their frequent stay program doesn't transfer over to starwood easily. but it certainly has its perks:

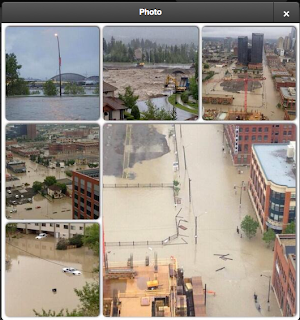

the pictures above aren't mine, obviously. i'm in no way adventurous enough to venture into the flood areas. there's a state of emergency and communities are evacuated, but because chateau mom and dad is located on the far south side of the city, no evacuation is needed here. so we will see how this holiday turns out.

on the travel front, none of my flights are affected. my dad has a flight out this afternoon, and most of the roads crossing any form of water are closed right now. we're not sure if it will be easy to get to the airport from where we are. air canada has issued a travel advisory on its website, and travel changes can be made without penalty for affected flights both today and tomorrow. i've never had to use their online rebooking tool before, but i may have to today.

stay safe, calgary.

- free toiletries

- complimentary daily breakfast

- complimentary laundry services

- queen size bed with heavenly bedding

- a no-bedbug guarantee

- free airport transfers (pending availability)

|

| oh no! a starwood hotel is being threatened! |

on the travel front, none of my flights are affected. my dad has a flight out this afternoon, and most of the roads crossing any form of water are closed right now. we're not sure if it will be easy to get to the airport from where we are. air canada has issued a travel advisory on its website, and travel changes can be made without penalty for affected flights both today and tomorrow. i've never had to use their online rebooking tool before, but i may have to today.

stay safe, calgary.

Thursday 20 June 2013

time to renew the costco membership ... downgrading to gold this time.

i signed up last year for a costco club membership. i was never a huge bulk buyer -- it's hard to go through that much food and household supplies for just a household of two. we have also been really bad at eating at home this last year. despite that, i thought i'd try costco just to see.

what were our savings?

the savings weren't too bad. there were certainly some gems out there. the main savings were:

executive membership = 2% bonus return

when i bought the membership though, i did it in conjunction with the aeroplan promotion that ran last year (up to 1,500 bonus miles). they said i could sign up for a gold membership ($55) or an executive membership (110$). the executive was like the gold except for my purposes, you would get a 2% rebate on all of your purchases. that meant that you'd need to spend roughly $2750 a year to break even. optimistically, i said yes.

so i arrived in calgary to find my rebate reward from costco today. i signed up using my alberta address so that a) my mom could have a family member card, and b) so that i could save on the 7% provincial tax. the dates were a bit off on the rebate reward, and after calling in to head office, i found out that i would get a grand total of $33.28. my powers of estimation were completely off.

they told me over the phone that i could just bring in my reward voucher and exchange it for another year of a $55 gold membership. "basically, your voucher is worth $55 now," she told me.

to renew or not to renew?

but despite the bare break-even, and despite the fact that i only spent $1664 there in the last year, i am too in love with the good meats and the giant bags of frozen veggies to go without a membership. and i'm also too much of a follower to be the only one of my friends to not have a membership. this means that i'll have to renew it again this year ... in alberta, of course, to save an extra 7%.

what were our savings?

the savings weren't too bad. there were certainly some gems out there. the main savings were:

- gillette fusion razor blade refills. normally 8 for $30 at superstore, but costco had them for 18 for $54 ($3.75 vs $3.00/razor)

- but then i later caught a super sale at london drugs: 8 for $20 ($2.50/razor).

- for whatever reason, we go through 60 a year, so we've purchased the package twice

- frozen mixed veggies. normally $4 for 750g at superstore, costco had them for $8.79 for 2.25kg. ($5.33/kg vs $3.91/kg). i think i bought about 8 bags throughout the year because i'm that lazy to cut everything up.

- tropicana orange juice, normally $14 for 4 at superstore on sale, costco sold for $11.79 for 4. we took advantage of this a lot.

- stamps: normally $0.61 per stamp, they were selling 100 for ~$58, or 0.58c. i bought a whole bunch and sold them to friends and family where needed

executive membership = 2% bonus return

when i bought the membership though, i did it in conjunction with the aeroplan promotion that ran last year (up to 1,500 bonus miles). they said i could sign up for a gold membership ($55) or an executive membership (110$). the executive was like the gold except for my purposes, you would get a 2% rebate on all of your purchases. that meant that you'd need to spend roughly $2750 a year to break even. optimistically, i said yes.

so i arrived in calgary to find my rebate reward from costco today. i signed up using my alberta address so that a) my mom could have a family member card, and b) so that i could save on the 7% provincial tax. the dates were a bit off on the rebate reward, and after calling in to head office, i found out that i would get a grand total of $33.28. my powers of estimation were completely off.

they told me over the phone that i could just bring in my reward voucher and exchange it for another year of a $55 gold membership. "basically, your voucher is worth $55 now," she told me.

to renew or not to renew?

but despite the bare break-even, and despite the fact that i only spent $1664 there in the last year, i am too in love with the good meats and the giant bags of frozen veggies to go without a membership. and i'm also too much of a follower to be the only one of my friends to not have a membership. this means that i'll have to renew it again this year ... in alberta, of course, to save an extra 7%.

Wednesday 19 June 2013

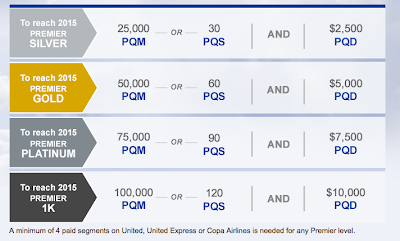

united is adding a minimum spend requirement to their elite program

browsing flyertalk today, there is a lot of reaction from yesterday's announcement by united airlines about changes to their elite program. starting in 2014, in order to earn status for 2015, they have implemented minimum spend requirements.

what are the changes?

this is similar to delta's changes (well, actually, it's almost the exact same graphic that they've used). for the minimum spend requirements, flights taken with united/united express/copa will all count. flights taken on star alliance and partner airlines also count provided that it was purchased on a united flight ticket (i.e., the ticket number begins with 016). carrier imposed fees also count. people living outside of the 50 american states, and those spending 25k annually on their affiliated credit cards are exempt (the latter does not hold true for the 1k level). i suspect that a lot of people living in seattle will be getting mailing addresses in the vancouver area in the near future.

what is the cost?

this works out to be a minimum of 10c per mile spend in order to achieve the equivalent status (e.g., 50,000 miles / $5,000 spend = 10c/elite qualifying mile). when i've booked flights between canada and the US, i typically hit lower than that. for example, i typically get over 7000 miles going to hawaii round trip for a cost of 450-550$, on my sea-yow run, i received 6000 miles for $500. each time, ~100$ was due to government fees and taxes, which do not count for minimum spend. so in order to reach the minimum spend, i'd probably end up flying over the required flight miles.

this new policy restricts bookings to united flight numbers only. for flights on another airline but sold as a united codeshare, those flights are typically more expensive than what the operating carrier would sell it for. for example, yvr-sfo on air canada metal is usually cheaper when purchased on aircanada.com (i.e., does not qualify for minimum spend requirement) than the exact same flight booked as a united code share (i.e., does qualify for minimum spend requirements). so in the end, instead of flying 50k on a whole bunch of airlines, it forces you to concentrate on certain airlines in particular.

who's next?

over the next few years, i plan to transition from asiana airlines to a north american program as i suspect i will be traveling more. and while these changes don't impact me yet, there are no guarantees that canada will continue to remain exempt. i also wonder who will be the next to catch the minimum-spend virus. flyertalkers speculate american will be next, although i doubt that would happen anytime soon given the merger that's underway. my main concern is with air canada.

air canada has been eager to play catch up by raising its altitude elite qualifying program requirements. it used to take 35k to earn the equivalent of star gold status, but now they require 50k. their reasoning was so that "it would be more in line with other airlines." never mind the fact that:

we will see ...

what are the changes?

this is similar to delta's changes (well, actually, it's almost the exact same graphic that they've used). for the minimum spend requirements, flights taken with united/united express/copa will all count. flights taken on star alliance and partner airlines also count provided that it was purchased on a united flight ticket (i.e., the ticket number begins with 016). carrier imposed fees also count. people living outside of the 50 american states, and those spending 25k annually on their affiliated credit cards are exempt (the latter does not hold true for the 1k level). i suspect that a lot of people living in seattle will be getting mailing addresses in the vancouver area in the near future.

what is the cost?

this works out to be a minimum of 10c per mile spend in order to achieve the equivalent status (e.g., 50,000 miles / $5,000 spend = 10c/elite qualifying mile). when i've booked flights between canada and the US, i typically hit lower than that. for example, i typically get over 7000 miles going to hawaii round trip for a cost of 450-550$, on my sea-yow run, i received 6000 miles for $500. each time, ~100$ was due to government fees and taxes, which do not count for minimum spend. so in order to reach the minimum spend, i'd probably end up flying over the required flight miles.

this new policy restricts bookings to united flight numbers only. for flights on another airline but sold as a united codeshare, those flights are typically more expensive than what the operating carrier would sell it for. for example, yvr-sfo on air canada metal is usually cheaper when purchased on aircanada.com (i.e., does not qualify for minimum spend requirement) than the exact same flight booked as a united code share (i.e., does qualify for minimum spend requirements). so in the end, instead of flying 50k on a whole bunch of airlines, it forces you to concentrate on certain airlines in particular.

who's next?

over the next few years, i plan to transition from asiana airlines to a north american program as i suspect i will be traveling more. and while these changes don't impact me yet, there are no guarantees that canada will continue to remain exempt. i also wonder who will be the next to catch the minimum-spend virus. flyertalkers speculate american will be next, although i doubt that would happen anytime soon given the merger that's underway. my main concern is with air canada.

air canada has been eager to play catch up by raising its altitude elite qualifying program requirements. it used to take 35k to earn the equivalent of star gold status, but now they require 50k. their reasoning was so that "it would be more in line with other airlines." never mind the fact that:

- domestic tango flights earn 0% elite qualifying miles (compared to the north american programs which give 100% on all fares)

- international tango, which is similarly priced to the american counterparts, earn 50% elite qualifying miles

- there is this ridiculous thing called air canada rouge which offers 400-800 status miles on flex fares when the actual distance is somewhere between 5-6x that much, depending on where you start

we will see ...

Sunday 16 June 2013

e-rewards: a fun idea, but it's time to say good-bye (until my next relapse)

i'm always on the hunt for new ways to get more miles and points. e-rewards is an online survey site which rewards users for taking part in market research surveys. these surveys are often about future products, promotions, or advertisements. sometimes, they can be involved with academic research studies.

whereas other sites pay in cash (e.g., quickrewards [referral link: here, but i barely use it anymore]), or points towards gift cards (e.g., mypoints), e-rewards gives dollar values for surveys taken, and then converts those dollars into airline/hotel chain points of your choosing. the participating partners that i have available for this one particular account are:

in order to sign up, you have to be invited by the actual hotel/airline program. based on who you sign up with, the possible programs you can cash out with will vary. before signing up with e-rewards, though, the invitations came pretty frequently ...

how does one earn e-reward dollars

you simply take surveys. they e-mail you when there are surveys available and applicable to you. it has to be done on a computer, as i find that most surveys are not supported by the ipad or iphone. it makes it difficult to do when you're wanting to do something while riding the train to work. from my own experience, a 30 minute survey will often yield ~$5 e-reward dollars. sometimes you'll get a 5 minute survey for $2. if you start a survey but don't qualify, there is generally a small token of appreciation ($0.25). sometimes, you'll complete a survey, but it won't load the last page, and so you've spent all that time to earn nothing.

how much are e-reward dollars worth?

some samples:

assuming that you get credited fully for your surveys (which, as long as it loads up the last page, i have always been credited appropriately), an hour of surveying gets roughly $10 e-rewards currency. mind you, even though i go through these surveys quite quickly, it still falls very closely to the advertised length of survey. here are some calculations:

what to do with my e-rewards account?

in some ways, because you can transfer e-reward dollars to programs at any time, it can make sense to maintain an account. it can be useful in a few ways:

(as a side note, i have previously redeemed $100 for a priority club reward, and $25 for american aadvantage ... and i currently have enough for another set of these awards, so i'm convincing myself a little bit late in the game).

whereas other sites pay in cash (e.g., quickrewards [referral link: here, but i barely use it anymore]), or points towards gift cards (e.g., mypoints), e-rewards gives dollar values for surveys taken, and then converts those dollars into airline/hotel chain points of your choosing. the participating partners that i have available for this one particular account are:

in order to sign up, you have to be invited by the actual hotel/airline program. based on who you sign up with, the possible programs you can cash out with will vary. before signing up with e-rewards, though, the invitations came pretty frequently ...

how does one earn e-reward dollars

you simply take surveys. they e-mail you when there are surveys available and applicable to you. it has to be done on a computer, as i find that most surveys are not supported by the ipad or iphone. it makes it difficult to do when you're wanting to do something while riding the train to work. from my own experience, a 30 minute survey will often yield ~$5 e-reward dollars. sometimes you'll get a 5 minute survey for $2. if you start a survey but don't qualify, there is generally a small token of appreciation ($0.25). sometimes, you'll complete a survey, but it won't load the last page, and so you've spent all that time to earn nothing.

how much are e-reward dollars worth?

some samples:

- united mileage plus / american aadvantage: $25 = 500 pts; $50 = 1000 pts; $100 = 2000 pts

- priority club: $30 / 1000 pts; $60 / 2200 pts; $100 / 4000 pts

- starbucks: $75 / $25 gift card; $145 / $50 gift card

assuming that you get credited fully for your surveys (which, as long as it loads up the last page, i have always been credited appropriately), an hour of surveying gets roughly $10 e-rewards currency. mind you, even though i go through these surveys quite quickly, it still falls very closely to the advertised length of survey. here are some calculations:

- starbucks cash rewards: after 7.5 hours, you will receive enough for a $25 gift card. this is roughly $3.33 an hour after tax. it would be like earning roughly $5/hr at a job.

- priority club: i value 1 priority club point at 0.5-1.0 cents per point (that is, a $125/night hotel will cost anywhere from 15,000 to 25,000 points). at the best e-rewards redemption rate, it will take 10 hours to earn 4,000 points. most optimistically, this is worth $40. this is $4/hr post tax, or roughly $6/hr pre-tax.

- united mileage plus: i value each united (or american, or air canada) mile at roughly 2 cents per mile, although some may suggest a maximum value of 5 cents per mile. it will take 2.5 hours in order to earn 500 points, or $10-$25. that's like earning $4-$10 post-tax, or $6-$15 pre-tax. the higher earning value is only realistic if you can actually redeem your points for business travel, which is never guaranteed.

what to do with my e-rewards account?

in some ways, because you can transfer e-reward dollars to programs at any time, it can make sense to maintain an account. it can be useful in a few ways:

- to generate activity to prevent expiry of the account

- to top off an account if you're just shy of a reward

- to generate activity as a requirement to meeting a bonus in an airline or hotel promotion

(as a side note, i have previously redeemed $100 for a priority club reward, and $25 for american aadvantage ... and i currently have enough for another set of these awards, so i'm convincing myself a little bit late in the game).

Saturday 15 June 2013

links from the web -- june 15, 2013

1) canadian kilometers writes about the $20 trick in vegas to get a free upgrade. this is a well-written about trick that i honestly don't know if i have the guts to try out for myself. but he tries it by slipping a $20 in his passport photo page, and innocently asking for a complimentary room upgrade to a higher floor. and it works. i'd rather get the complimentary upgrade because i've earned it with status, though.

2) hack my trip has a screen shot of the new united interface that gate agents use. it appeals to the airline enthusiast in me to figure out how they determine if involuntary denial of boardings (bumps) are required.

3) on an older note, there was a wonderful post done by a united gate agent in 2006 which described the rules as to how he would assign operational upgrades in the case where planes were oversold in the back but not in the front, or at least how they were processed. it would appear that the common held belief that schmoozing up to the gate agent makes an upgrade no more or less likely. upgrades, as he explains, are done solely to help the company.

4) late on this, but view from the wing notes that you can get free virgin atlantic silver status. they don't have any meaningful partnerships which would impact my own travel. if they were a part of an alliance, then i would probably sign up as it would likely give me an increased free luggage allowance on those member airlines. but because they're not, and because there are no free miles being handed out here as well, it's an offer that i'll just let sit. (the benefits of silver status are here, and there is note that there may be a partnership with delta in the works).

5) from my favorite canadian deals blog, smartcanucks links to a 15-20% off coupon for all purchases at the hudsons bay company valid until sunday, jun 16, 2013. i remember how when i was growing up, that was the only place where i used to shop. pretty much now, it's still the only place i go to for household stuff.

2) hack my trip has a screen shot of the new united interface that gate agents use. it appeals to the airline enthusiast in me to figure out how they determine if involuntary denial of boardings (bumps) are required.

3) on an older note, there was a wonderful post done by a united gate agent in 2006 which described the rules as to how he would assign operational upgrades in the case where planes were oversold in the back but not in the front, or at least how they were processed. it would appear that the common held belief that schmoozing up to the gate agent makes an upgrade no more or less likely. upgrades, as he explains, are done solely to help the company.

4) late on this, but view from the wing notes that you can get free virgin atlantic silver status. they don't have any meaningful partnerships which would impact my own travel. if they were a part of an alliance, then i would probably sign up as it would likely give me an increased free luggage allowance on those member airlines. but because they're not, and because there are no free miles being handed out here as well, it's an offer that i'll just let sit. (the benefits of silver status are here, and there is note that there may be a partnership with delta in the works).

5) from my favorite canadian deals blog, smartcanucks links to a 15-20% off coupon for all purchases at the hudsons bay company valid until sunday, jun 16, 2013. i remember how when i was growing up, that was the only place where i used to shop. pretty much now, it's still the only place i go to for household stuff.

Wednesday 12 June 2013

adventures in hotel bookings -- random updates

1) when i was talking about points hound the other day, i had said that it might be a good alternative because the rebates via great canadian rebates and big crumbs weren't reliable for the actual hotel websites. if you wanted hotel chain points and stay credits, you had to book on the actual hotel websites. after completing my stays at various sheraton hotels in march and april, i had yet to receive my 2.1% credit for my stays on either website. frustrated, i booked on points hound instead.

and then, in my e-mail this week, i find out that i was being too impatient:

so perhaps i spoke too soon. i'm definitely happy that my rebates came through!

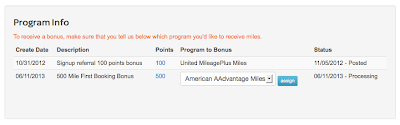

2) i did actually book a starwood "double dip" stay on points hound. these "double dip" rates offer a few miles / dollar spent in addition to hotel chain points and stay credits. but what i completely forgot about was that there was a 500 point first booking bonus. it's credited to my points hound account and simply needs to be assigned to a partner program (like united mileage plus or american aadvantage). it's a super easy process.

you'll notice that my sign-up bonus was credited to united mileage plus -- that's because they were the only program to offer points initially. from here on out, i think i'll work on my american aadvantage account. i already have a small sum in aadvantage points, and i need an aadvantage account to dump all of my occasional oneworld points in. i still need to weigh whether 2 miles / dollar is equal to whatever big crumbs and great canadian rebates can offer me, though.

3) i was planning on doing another seattle mattress run during the august long weekend when i suddenly remembered that that is the vancouver pride parade weekend! it's always fun, and on a travel related note, during the parade over the last few years:

4) oh, and i just randomly found out that starbucks is having a $10 card for $5 from groupon. use bigcrumbs in order to get 5.6% cash back too.

and then, in my e-mail this week, i find out that i was being too impatient:

|

| great canadian rebates |

|

| big crumbs |

2) i did actually book a starwood "double dip" stay on points hound. these "double dip" rates offer a few miles / dollar spent in addition to hotel chain points and stay credits. but what i completely forgot about was that there was a 500 point first booking bonus. it's credited to my points hound account and simply needs to be assigned to a partner program (like united mileage plus or american aadvantage). it's a super easy process.

you'll notice that my sign-up bonus was credited to united mileage plus -- that's because they were the only program to offer points initially. from here on out, i think i'll work on my american aadvantage account. i already have a small sum in aadvantage points, and i need an aadvantage account to dump all of my occasional oneworld points in. i still need to weigh whether 2 miles / dollar is equal to whatever big crumbs and great canadian rebates can offer me, though.

3) i was planning on doing another seattle mattress run during the august long weekend when i suddenly remembered that that is the vancouver pride parade weekend! it's always fun, and on a travel related note, during the parade over the last few years:

- westjet was distributing %-off vouchers

- flight center was distributing $25 off coupons for domestic airfare

4) oh, and i just randomly found out that starbucks is having a $10 card for $5 from groupon. use bigcrumbs in order to get 5.6% cash back too.

Sunday 9 June 2013

petro-canada's pivot visa: a primer for getting a little bit more value out of your credit card purchases

petro-canada has really been promoting its pivot visa card lately. it's a reloadable card that you can buy at the retail gas stations. the start-up cost is roughly $10 to purchase the card. you can use it anywhere visa is used, including online.

in general, i don't believe in pre-paid cards.

there are two kinds of pre-paid cards: the reloadable kind and the non-reloadable kind.

when the petro-canada pivot visa card came out, i did my own calculations, and i took the plunge to become a reloadable pre-paid card holder. i'll explain the bad stuff first (the fees) before the good stuff (the rewards).

the details: fees

i have the pay & go version. the whole fee structure is in the pictures below, but the most pertinent details are as such:

*note: purchasing these vouchers do not give you petro-points.

the details: i only use this card in conjunction with the scotia bank amex card

a few months ago, i successfully applied for the scotiabank american express card. this is a card with a $99 annual fee. the selling point of this card is that you get 4% in travel cash back in gas, grocery, dining, and entertainment, and 1% everywhere else. i repeat: purchases made at petro-canada give you a 4% return. in comparison to my 2% cash back mastercard, i get an additional 2% bonus using this amex.

scenario 1: making actual purchases. i would only use this technique if a) there are no readily available gift cards for that store that you can purchase at grocery/gas stations, b) if the grocery store that you regularly use does not accept amex (like superstore), or c) if these are very large online non-bonused charges, like airline tickets.

would this be worthwhile for any other kind of credit card?

this technique doesn't work very well with other cards in canada, unfortunately. this technique has been widely used in the states, in a process known as "manufactured spending". it only works if there is a significant bonus specifically for gas stations. another card which does this would be the cibc aerogold/adventura card which give an additional 50% miles for gas/grocery stores. that means that for every $1 in spending at a gas station, you get a bonus 0.5 aeroplan point.

using scenario 1 above, spending $500 on the aerogold card to buy 500$ in pivot visa vouchers to spend on $500 worth of travel would net you an additioanl 250 aeroplan points. this is at a cost of $4.52. therefore, you are buying each additional aeroplan point for 1.8c/mile. using scenario 2 above, you will receive 375 aeroplan points to buy the voucher, and pay $6.50, which is about equal to 1.73c/mile. given my previous analysis of the value of an aeroplan mile, it seems a bit steep. (link: cash back credit card comparison)

one last benefit: fuel savings!

when you buy the card, they provide you with an fuel savings card that's linked to your account online. for every dollar you reload onto your card, you get 5c off of one liter of gas to a max of 250 liters at any given time. so for every $250 load, you'll top up your fuel savings card to 250L. i'll probably give this to my parents and brother to use since they burn through gas faster than i do (i tend to fill up south of the border). at 5c a liter, and using maybe 300L a month, that's an additional reward of $15 a month.

final thoughts:

i'm really hoping for a better card product in canada that would provide a better bonus for spending at gas stations. if there is such a product, i'm sure i'd be maxing out this this pivot visa every single month. for now, it's just a game of convenience -- i'd only do this if i were already at a petro-canada station for some other reason. i would never go out of my way to do this -- the few extra dollars i get from this aren't worth the extra gas money ;)

in general, i don't believe in pre-paid cards.

there are two kinds of pre-paid cards: the reloadable kind and the non-reloadable kind.

- non reloadable cards usually charge an activation fee. the most favorable ratio is generally with the highest value card (e.g., $6.95 for 200$ vs. $3.95 for a 25$ vanilla non-reloadable mastercard).

- reloadable cards generally charge a fee for the card and then another charge a fee for each transaction or a monthly fee. furthermore, they usually don't let you re-load using a credit card.

when the petro-canada pivot visa card came out, i did my own calculations, and i took the plunge to become a reloadable pre-paid card holder. i'll explain the bad stuff first (the fees) before the good stuff (the rewards).

the details: fees

i have the pay & go version. the whole fee structure is in the pictures below, but the most pertinent details are as such:

- price of card: $10 -- one time fee (the card itself expires in 3 years, like a regular credit card)

- cost of reloading a card via voucher: $2 regardless of denomination. you buy these vouchers at petro-canada stations. i've seen $25, $50, $100, and $250. it makes absolutely no sense to refill only $25 ... that's almost a 10% fee right there!

- when you reload it online, the $2 fee is taken out right away. in other words, when i enter a $250 card, my account is only credited $248. no taxes!

- you can reload a maximum of $500 a day, and $2000 a month

- cost of making a purchase = $0.49 each. this is on top of your regular purchases (e.g., on your $100 purchase, your account gets debited $100 and $0.49). making multiple small purchases is a bad use of the card.

- cost of withdrawing cash from an atm = $3 + whatever the atm operator charges (e.g., cibc / rbc = $2.00, td = $1.50)

- you can withdraw a maximum of $250 a day

- there is a spending cap of $2,500 a day

*note: purchasing these vouchers do not give you petro-points.

the details: i only use this card in conjunction with the scotia bank amex card

a few months ago, i successfully applied for the scotiabank american express card. this is a card with a $99 annual fee. the selling point of this card is that you get 4% in travel cash back in gas, grocery, dining, and entertainment, and 1% everywhere else. i repeat: purchases made at petro-canada give you a 4% return. in comparison to my 2% cash back mastercard, i get an additional 2% bonus using this amex.

scenario 1: making actual purchases. i would only use this technique if a) there are no readily available gift cards for that store that you can purchase at grocery/gas stations, b) if the grocery store that you regularly use does not accept amex (like superstore), or c) if these are very large online non-bonused charges, like airline tickets.

- i buy large gift certificates at superstore. in order to buy a $500 superstore gift card, i need to buy 2.016 reloadable cards (because each $250 card will only credit $248 to my account) with a fee of $2 each. i will also be charged one purchase fee of $0.49. overall cost = (2.016 cards * $2/card) + $0.49 = $4.52

- if i were to spend 500$ on my regular 2% cash back card, i'd receive $10 in rewards. spending $504.52 on my amex card will give me $20.18 in rewards. so using my amex will get me an additional $10.18 in rewards. subtracting the $4.52 extra re-loadable card fees means that i get a net of $5.66 extra that i wouldn't have normally gotten from my 2% card. that's like an extra 1.13% in rewards that i wouldn't normally have.

- i would only use this method if i know that i can burn through this gift card reasonably quickly. with superstore, i know i can.

- reload, deposit your pin online, and then withdraw $240 from the atm. for every $250 cycle, you pay $2 in reload fees, $3 in atm withdrawal fees, $1.50 in atm-provider fees. this is a total of $6.50 in fees.

- using the amex card, you will get 4% back on your 250$ purchase, or $10. this is a net profit of $3.50.

- buy 8 reload voucher at a time (to save time), but you can only load $500 a day.

- there is the risk of loss if a) you lose any of your unused vouchers, or b) if you misplace your $240 that you pull from the atm.

would this be worthwhile for any other kind of credit card?

this technique doesn't work very well with other cards in canada, unfortunately. this technique has been widely used in the states, in a process known as "manufactured spending". it only works if there is a significant bonus specifically for gas stations. another card which does this would be the cibc aerogold/adventura card which give an additional 50% miles for gas/grocery stores. that means that for every $1 in spending at a gas station, you get a bonus 0.5 aeroplan point.

using scenario 1 above, spending $500 on the aerogold card to buy 500$ in pivot visa vouchers to spend on $500 worth of travel would net you an additioanl 250 aeroplan points. this is at a cost of $4.52. therefore, you are buying each additional aeroplan point for 1.8c/mile. using scenario 2 above, you will receive 375 aeroplan points to buy the voucher, and pay $6.50, which is about equal to 1.73c/mile. given my previous analysis of the value of an aeroplan mile, it seems a bit steep. (link: cash back credit card comparison)

one last benefit: fuel savings!

when you buy the card, they provide you with an fuel savings card that's linked to your account online. for every dollar you reload onto your card, you get 5c off of one liter of gas to a max of 250 liters at any given time. so for every $250 load, you'll top up your fuel savings card to 250L. i'll probably give this to my parents and brother to use since they burn through gas faster than i do (i tend to fill up south of the border). at 5c a liter, and using maybe 300L a month, that's an additional reward of $15 a month.

final thoughts:

i'm really hoping for a better card product in canada that would provide a better bonus for spending at gas stations. if there is such a product, i'm sure i'd be maxing out this this pivot visa every single month. for now, it's just a game of convenience -- i'd only do this if i were already at a petro-canada station for some other reason. i would never go out of my way to do this -- the few extra dollars i get from this aren't worth the extra gas money ;)

Labels:

credit card,

manufactured spending,

petro-points

Saturday 8 June 2013

points hound: earning bonus miles while still getting stay credits for hotel bookings

the problem with booking with third party sites (e.g., expedia, orbitz, priceline) for hotel bookings is that for the most part, you won't get any stay credits with the hotel chain that you've booked. despite paying probably the same price, there are no points earned or stays/nights earned for hotel status.

expedia and friends do have an advantage to them, however. usually, they have higher rebates on sites like bigcrumbs.com. if shopping through bigcrumbs, expedia gives a rebate of 5.6% back on hotel purchases, whereas for starwood properties, they give a 2.1% rebate on hotel purchases (if it credits at all). this is in addition to a 1-2% rebate via expedia's own points program. hotels.com offers a 4.55% rebate on bigcrumbs.com, in addition to an effective 10% return via their hotelrewards program.

what is pointshound?

points hound is an online, third party hotel booking service that provided an interesting proposition. you earn various amounts of points on your hotel bookings based on how many nights you've booked with them in the past.

it's not completely clear if it's 0-5 nights per year or based on some other time frame. and when they say 3-8x, they really mean 3-8 points earned per dollar spent. they have several partners you can credit your miles to: united, virgin america, american, delta, aeromexico, hawaiian, baltic, etihad, and us airways.

at a conservative 7 miles per dollar spent after 20+ nights, and assuming 2c value per mile, that's like getting a 14% return. if you had booked the same property on hotels.com (using canadian currency, thereby removing the forex fee of 2.5%), you would get 10% back via welcomerewards and 4.55% back via a rebates from bigcrumbs, or 14.55% total return. guaranteed cash. airline miles are never guaranteed.

pointshound and double dipping

but recently, points hound started to do something that was quite innovative. they've teamed up with the various hotel chains to allow users to earn hotel chain points and stay credits in addition to a reduced amount of airline miles. fantastic!

i'm planning on going to seattle for a weekend trip (as i usually do), and am interested in staying at a particular starwood hotel.

normally, you can earn 400 mileage plus points for a $159 hotel night, or slightly less than 3 miles/$ spent. this would not earn you any points with starwood. i would value 400 miles as being worth $8 to $16 (2-4 cents/mile). if i book through hotels.com, i would expect to get back $7.23 from bigcrumbs and $15.90 back from hotelrewards. so pointshound would not be that great. neither website would give you starwood points or stay credits.

but see that "double dip" icon in the bottom? that means that if you agree to earning a lower number of mileage plus points via pointshound, you can get rates that are eligible for starwood points and stay credits.

expedia and friends do have an advantage to them, however. usually, they have higher rebates on sites like bigcrumbs.com. if shopping through bigcrumbs, expedia gives a rebate of 5.6% back on hotel purchases, whereas for starwood properties, they give a 2.1% rebate on hotel purchases (if it credits at all). this is in addition to a 1-2% rebate via expedia's own points program. hotels.com offers a 4.55% rebate on bigcrumbs.com, in addition to an effective 10% return via their hotelrewards program.

what is pointshound?

points hound is an online, third party hotel booking service that provided an interesting proposition. you earn various amounts of points on your hotel bookings based on how many nights you've booked with them in the past.

it's not completely clear if it's 0-5 nights per year or based on some other time frame. and when they say 3-8x, they really mean 3-8 points earned per dollar spent. they have several partners you can credit your miles to: united, virgin america, american, delta, aeromexico, hawaiian, baltic, etihad, and us airways.

at a conservative 7 miles per dollar spent after 20+ nights, and assuming 2c value per mile, that's like getting a 14% return. if you had booked the same property on hotels.com (using canadian currency, thereby removing the forex fee of 2.5%), you would get 10% back via welcomerewards and 4.55% back via a rebates from bigcrumbs, or 14.55% total return. guaranteed cash. airline miles are never guaranteed.

pointshound and double dipping

but recently, points hound started to do something that was quite innovative. they've teamed up with the various hotel chains to allow users to earn hotel chain points and stay credits in addition to a reduced amount of airline miles. fantastic!

i'm planning on going to seattle for a weekend trip (as i usually do), and am interested in staying at a particular starwood hotel.

normally, you can earn 400 mileage plus points for a $159 hotel night, or slightly less than 3 miles/$ spent. this would not earn you any points with starwood. i would value 400 miles as being worth $8 to $16 (2-4 cents/mile). if i book through hotels.com, i would expect to get back $7.23 from bigcrumbs and $15.90 back from hotelrewards. so pointshound would not be that great. neither website would give you starwood points or stay credits.

but see that "double dip" icon in the bottom? that means that if you agree to earning a lower number of mileage plus points via pointshound, you can get rates that are eligible for starwood points and stay credits.

in this example, you can still get 350 mileage plus credits (just over 2 miles/$ spent), the hotel rate is different (AAA rate, which i'm a member of, and refundable), and you get the stay credit and starwood points. if i were were to have solely booked through bigcrumbs to get a 2.1% rebate for purchases made at spg.com, i would get $3.38 in rebates. i value 350 mileage plus points at $7-$14 (2-4 cents/mile). not bad. and as i haven't booked on bigcrumbs before, the number of miles could potentially increase as i climb that ladder.

i'll bite. i'll make a booking and see how it goes. hopefully the stay credit will come through!

(note: if you sign up with points hound using my link above, you get 250 sign up miles, and i'll get 250 referral miles after your first purchase).

Thursday 6 June 2013

links from the web: air canada promo edition

- CIBC aerogold/adventura card first year free promo. this one is churnable, i've heard. if you're into collecting aeroplan points, this may be a cheap way to do so. it comes with a 15,000 point bonus after spending $500 a month for the first three months. 15,000 free points is a great deal, although i would value this at $150-$300 in travel discounts.

- air canada has a double status mile promotion going on from may 27-jul 31, new bookings only. this is available for rapidair flights (YYZ - YOW/YUL), and from canada to various eastern seaboard. learn more and register here. i think this is a very valuable promo as a round trip flight from YVR to EWR (via YYZ) would normally give you ~5200 status miles (assuming a 500 mile minimum). with the double status mile promotion, you get 10,400. it's a pretty decent dent in earning air canada altitude 50k (star gold) status.

- i really like view from the wing's commentary on delta's decision to no longer award qualifying miles on korean airlines, a full member of their skyteam alliance.

Lucky reports Delta’s absurd explanation.

We’d like you to understand that each airline determines its level of participation in partnership with us, so there are varying levels of customer rewards when flying with our partners.Because, of course, “we would prefer that your customers not get recognized for travel with us” is what Korean Air said never.

Wednesday 5 June 2013

delta to no longer award elite qualiflying miles for korean airline flights.

i'm not a big collector of delta's skymiles. i have an account only because i took a flight on malaysia airlines and china eastern airlines one time and needed a place to park those miles in an account with a generous expiration policy (i.e., supposedly never). i haven't used the program enough to know how good or bad the program is. however, i've read so much about their elite program and how unfriendly it has become.

earlier this year, delta added a new requirement for earning elite status in their program. starting in 2013 for the 2014 program year, they added the concept of medallion qualifying dollars. for american residents, one would need to spend $5,000 a year on delta airlines in order to earn gold status in addition to the previous qualifying segment/qualifying point requirements. this spend includes only base fares and fuel surcharges, not government imposed taxes (which can be quite bulky on international and even canadian destinations).

what made things even more restrictive was that even though alliance partner flights would earn qualifying segments or miles, they would not qualify for the qualifying dollar amounts unless they were on delta-marketed flights. and if you bought a code-share version of a delta flight (e.g., sitting in a delta aircraft but on an alaska airlines flight number), it would not count. so unless that alaska airlines flight you were taking was a code-share with delta, and you bought the DL flight number rather than the AS flight number, then that wouldn't count towards your qualification.

and today, they made it worse.

i (and i'm sure everyone else) received an e-mail from delta this morning telling me about "future mileage earning on partner flights". what they've done is that they've simplified their earning chart. the simplification of the chart isn't a bad thing. it makes it easier to know what you may or may not receive in terms of qualifying points on partner airlines.

they've divided up the chart into four sections:

the additional spend requirements in addition to the fewer partners with which to earn qualifying points on will make delta just a little bit harder to earn status with.

why is this important?

concepts tend to be infectious. in the last few months, when one american airline increased their change fees, all of the other american legacy carriers followed suit. when one airline wanted to add checked baggage fees, everyone followed suit. and so the worry is what will happen if air canada or other airlines were to add very restrictive minimum spend requirements per year? or what if various members of the star alliance no longer recognize and reward travel on other members of the star alliance? for an infrequent flyer like myself who obtains status in non-traditional ways, changes like these certainly seem scary. i'll be keeping an eye out over the next few years to see what happens.

earlier this year, delta added a new requirement for earning elite status in their program. starting in 2013 for the 2014 program year, they added the concept of medallion qualifying dollars. for american residents, one would need to spend $5,000 a year on delta airlines in order to earn gold status in addition to the previous qualifying segment/qualifying point requirements. this spend includes only base fares and fuel surcharges, not government imposed taxes (which can be quite bulky on international and even canadian destinations).

what made things even more restrictive was that even though alliance partner flights would earn qualifying segments or miles, they would not qualify for the qualifying dollar amounts unless they were on delta-marketed flights. and if you bought a code-share version of a delta flight (e.g., sitting in a delta aircraft but on an alaska airlines flight number), it would not count. so unless that alaska airlines flight you were taking was a code-share with delta, and you bought the DL flight number rather than the AS flight number, then that wouldn't count towards your qualification.

and today, they made it worse.

i (and i'm sure everyone else) received an e-mail from delta this morning telling me about "future mileage earning on partner flights". what they've done is that they've simplified their earning chart. the simplification of the chart isn't a bad thing. it makes it easier to know what you may or may not receive in terms of qualifying points on partner airlines.

they've divided up the chart into four sections:

- airlines where you will always earn full qualifying points and class of service bonuses

- airlines where you will earn less than 100% qualifying miles but will earn class of service bonuses

- airlines where you will earn less than 100% qualifying miles and no class of service bonus

- airlines where you will not earn qualifying miles nor class of service bonuses

the additional spend requirements in addition to the fewer partners with which to earn qualifying points on will make delta just a little bit harder to earn status with.

why is this important?

concepts tend to be infectious. in the last few months, when one american airline increased their change fees, all of the other american legacy carriers followed suit. when one airline wanted to add checked baggage fees, everyone followed suit. and so the worry is what will happen if air canada or other airlines were to add very restrictive minimum spend requirements per year? or what if various members of the star alliance no longer recognize and reward travel on other members of the star alliance? for an infrequent flyer like myself who obtains status in non-traditional ways, changes like these certainly seem scary. i'll be keeping an eye out over the next few years to see what happens.

Subscribe to:

Posts (Atom)