last week, united announced new changes to their mileage award charts. it's not easily identified on the website, and you have to hunt around for the changes. the new, updated chart is found

here in their program PDF.

effective february 1, 2014, they've done a few things with their award chart. they've split the united awards from their star alliance awards, with the latter generally being more expensive than the former. the detailed analysis can be found on the

flyertalk thread dedicated to this. the executive summary is this:

- F (first) and J (business) travel on united metal increases by 5-20%

- J travel on partner metal increases by 20-40%

- F travel on partner metal increases by 40-86%

- complimentary premier upgrades and regional/global premier upgrades are no longer being offered on intra-asia flights and on flights between north and south america

they provided 3 months notice for these changes, and all tickets booked until february 1, 2014 will be under the old rules.

with my travel patterns, the rewards that i most care about are for travel to singapore as i often head down there for family reasons. singapore is classified as south asia. with air canada's aeroplan, my business class ticket cost 125,000 aeroplan miles. if i could find first class segments, it would cost me 170,000 aeroplan miles.

using united's current award chart, i would need 120,000 points for business and 140,000 points for first class. using united's

new award chart for travel including partner flights, i would need 160,000 points for business class and

260,000 for first class. (in contrast, if i were to just stick with united metal, it would be 140,000 and 160,000 miles, respectively). this represents up to an 86% increase for first class award tickets.

given the fact that earning miles from flights generally yields the same number of points on both the aeroplan program, and in general, the number of miles earned via credit card are similar (roughly 1pt / $1), it seems that air canada offers the better redemption value. aeroplan requires fewer miles for the same amount of distance traveled. (of note, in canada, the only credit card that offers mileage plus points is the SPG amex, where 2 SPG points = 1.25 united mileage plus points).

it's a definite devaluation.

does this change what i do with my credit card earnings?

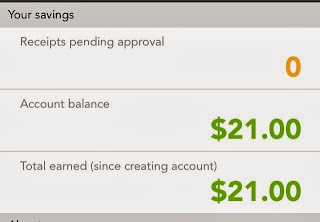

i don't have much stored in united. most of my points, if anything, were stored in aeroplan until i finally redeemed them a few weeks ago to my

almost-all-business class tickets to asia. if anything, i've stopped collecting miles in frequent flyer points, and just opted for cash back instead. i use my

scotia bank gold american express for 4% back on gas, grocery, dining, and entertainment, and my

pivot visa on everything else for 3.2% cash back. you have to be very lucky to consistently get 3.2%-4% return on flight bookings in premium class. and cash's versatility has value of its own.

does this change which program i credit my miles to on flights?

i haven't flown very much for the

redeemable miles, which is what is being affected now. rather, i fly to ensure that i have enough

status miles to maintain my elite status. at the current time, i don't fly as much as most people do. therefore, crediting to asiana airlines won't change. i still fly enough to earn asiana diamond (star gold) status, which is 40,000 miles for every 24 month cycle. i expect to be on track to renew my gold status with them and hold onto that status until at least november 2016.

after this year, travel patterns may change. because my primary goal, as a mid-level flyer and mid-tier elite, is to maintain star gold, i may still switch to united's program. the benefits include:

- 100% status miles (for now) on all non-domestic fares on air canada. this makes it easier to achieve and maintain the 50k status mark when flying on transpacific/transatlantic tango fares on air canada

- additional redeemable bonus miles earned on flights taken when you have premier gold status with a negligible bonus on asiana. while redeemable miles aren't my goal, the option of having more is certainly nice

- free access to premium economy on united metal without the need to beg for it

- the possibility of unlimited domestic upgrades

the downside is the loss of domestic united club lounge access for domestic (and canadian) flights.

lessons to learn ...

- inflation happens with every kind of currency. stockpiling points is never a good idea because the value of the point never increases in value. i'm glad that i managed to spend the remainder of my aeroplan points on my upcoming trip to asia. i'm glad that i burnt through my priority club points on my hotel stay in san francisco back in september. i still have to burn through the miles that i've earned on asiana via flights. i still have to burn through my starpoints earned solely from my stays at starwood hotels.

- if i really wanted to earn points through credit card spending, the best bet is still the starwood preferred guest american express. this card allows you to earn 1 starpoint per dollar spent, and 1 starpoint is about equivalent to 1.25 airline points.

- because there are so many transfer partners, it decreases the risk of program devaluation somewhat by allowing you to transfer to programs that have devalued the least.

but for now, even post devaluation, the travel pattern and frequent flyer programs will stay the same.