1) taken from smart canucks, you can fill in this 5-question survey re: transportation options in the greater toronto area for 10 airmiles. this is limited to the first 12,000 respondents. it's easy and probably not intended for everyone to do, but i couldn't say no to a freebie. the direct link is here.

2) from view from the wing, hyatt is offering a free 100 points to celebrate chinese new year. the direct link is here. it's good until february 15, 2014.

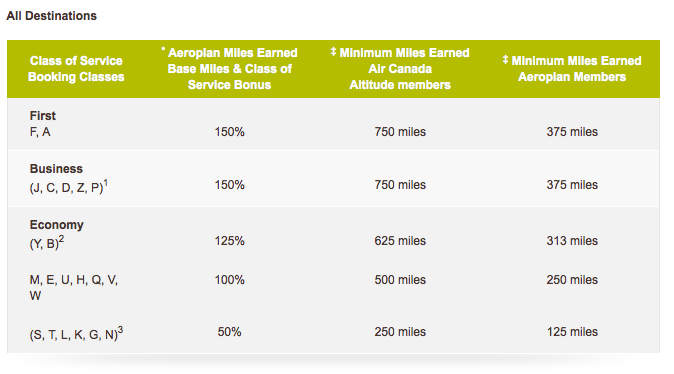

3) canadian kilometers notes that aeroplan has now decreased the number of miles earned on united flights. united flights used to earn at least 100% across all fare classes, but effective april 1, 2014, the cheapest fares go down to 50%. on the upside, those who are willing to spend money on the more expensive classes and products (including business and first) will receive higher earning rates. the net impact for me: future possibilities of earning status on air canada just became that much harder. the most important thing is that asiana doesn't follow suit. at the time of writing, so far, they haven't.

trying to figure out my way around points, status, and making travel that much easier.

Sunday 26 January 2014

Wednesday 15 January 2014

50% bonus base miles on all american airlines and us airways flights until march 2, 2014

everyone knows that american and us airways are merging. we know that us airways is maintaining its own frequent flyer program before merging with american. we know that until march 1, us airways will exit the star alliance on march 30, 2014 and then join the oneworld alliance on march 31, 2014. at some later date, the programs will be merged into the american program. it's a unique proposition because this means that effectively, all star alliance miles can be credited towards a oneworld program.

in my e-mail, i received an offer from american airlines. for every us airways flight that you credit towards the aadvantage program, you will receive a 50% bonus on the base mileage (or minimum mileage, if applicable). this is only for flights operated by us airways and its subsidiaries. it is also good for flights marketed by american airlines but operated by us airways. registration prior to march 2, 2014 is required. the bonus is applicable for flights taken between january 13, 2014 and march 2, 2014. so it's best to register anyway just in case.

on the us airways website, there is a reciprocal offer for crediting american airline operated flights to the us dividend mileage program. same terms and conditions. registration is required and can be done so here.

what this means is that until march 2, 2014, when flying on either of these carriers, you get a 50% bonus. i think it's a great deal if:

in my e-mail, i received an offer from american airlines. for every us airways flight that you credit towards the aadvantage program, you will receive a 50% bonus on the base mileage (or minimum mileage, if applicable). this is only for flights operated by us airways and its subsidiaries. it is also good for flights marketed by american airlines but operated by us airways. registration prior to march 2, 2014 is required. the bonus is applicable for flights taken between january 13, 2014 and march 2, 2014. so it's best to register anyway just in case.

on the us airways website, there is a reciprocal offer for crediting american airline operated flights to the us dividend mileage program. same terms and conditions. registration is required and can be done so here.

what this means is that until march 2, 2014, when flying on either of these carriers, you get a 50% bonus. i think it's a great deal if:

- you currently have no status and will likely not achieve status for the year

- you currently have star alliance status and have enough travel planned to be able to safely divert some star alliance miles into the aadvantage

- you do not receive much of a elite bonus when flying us airways

Saturday 11 January 2014

so i bought my way to starwood platinum status last year ...

last year, despite a car accident washington state, i decided to run for platinum status with starwood. i had planned an 8-stay mattress run between seattle and portland but that was cut short after just two nights. so i was left with a 6 night deficit.

i called the sheraton portland airport the monday of my accident to tell them that i wouldn't be able to make it in that night. given that it wasn't a prepaid rate, they were kind enough to cancel the reservation without penalty despite being past the cancellation period. i called the four points by sheraton portland east to ask if i could cancel my award stay for the following day, despite being past the cancellation deadline. they kindly agreed to refund me the points as well.

however, a few days later, i realized that the four points had charged me a $135 no show rate while giving me a stay credit at the same time for it. i called in to the office and it was eventually all sorted out. i was certain that they'd also reverse the stay credit, but they didn't.

so i was in this odd position of only needing 5 extra stay credits in the month of december to earn platinum status. and i decided to go for it.

total cost:

i spent $847. i had $90 in savings, i got back $195 in points, and $290 in other quantifiable benefits. this equates to a $272 investment for a year of platinum. it's not as much as my mileage run 3 years ago that earned me star gold status with asiana airlines. the quantifiable benefits of star gold status were clearly worth it. however, we will see whether the qualitative benefits of starwood platinum status is worth it.

i called the sheraton portland airport the monday of my accident to tell them that i wouldn't be able to make it in that night. given that it wasn't a prepaid rate, they were kind enough to cancel the reservation without penalty despite being past the cancellation period. i called the four points by sheraton portland east to ask if i could cancel my award stay for the following day, despite being past the cancellation deadline. they kindly agreed to refund me the points as well.

however, a few days later, i realized that the four points had charged me a $135 no show rate while giving me a stay credit at the same time for it. i called in to the office and it was eventually all sorted out. i was certain that they'd also reverse the stay credit, but they didn't.

so i was in this odd position of only needing 5 extra stay credits in the month of december to earn platinum status. and i decided to go for it.

total cost:

- i stayed at various hotels within my own cities (vancouver and calgary). i did not include the cost of time, nor did i include the cost of "embarrassment."

- each paid hotel night cost roughly $130 on average after taxes. i had one category 3 hotel stay at 7,000 points. i stayed six nights (thus six stays) in total just in case they decided to reverse that extra stay credit (which they didn't end up doing). because i get a 2% rebate on my no-fee mbna mastercard, the cash portion went down to $637.

- when redeeming for category 2 hotels, you can easily get a 3 cent per point return. therefore, 7,000 points is equal to $210.

- total cost: $847.

- i also took into consideration the fact that throughout the year, i split up numerous trips into multiple stays (e.g., two different hotels over the weekend instead of staying all throughout).

- two of those nights were for date night purposes with the +1. by staying in downtown calgary one night, we went out for drinks without having to worry about the $60 cab fare home. we enjoyed the free breakfast in the lounge which i would value at $10 each. we also enjoyed the free evening appetizers which i would value at $5 each. total value for that night out was $90.

- i was one night away from their 2013 third trimester promo bonus (double points, and 2,500 points until december 15). so for two of my nights, i got 492 double points and 2,500 bonus points, for a total of 2,992 points.

- all of my extra stays were either sheraton or westins. as a gold member, i received 250 points for each stay except for my last one, where i opted for a movie instead (valued at $16.79). if we value the movie at 500 points, that means that i received 1,750 points.

- all of my stays received a base 3 starpoints per dollar spent before taxes. i received 1,755 starpoints.

- i think i received an extra 118 starpoints out of error. but i honestly am not motivated enough to go through all my statements to confirm.

- in total, i received 6,497 points, which would be equal to $195.

- i expect that i will have 25 stays in the 2014 year, at a 1:1 ratio between hotels that offer a 250 point platinum amenity bonus or 500 point amenity bonus. this is an additional 125 to 250 bonus points compared to the gold amenity. thus, i expect to earn 187.5 extra point being average per stay. this works out to 4,687 extra platinum points this year. that's worth $140.

- there is guaranteed internet access as a platinum. in america, despite having my mobile internet hospot from walmart, hotel wifi is generally faster and more convenient. as a gold member, you can have free internet in exchange for your gold amenity. for westin and sheraton, this is worth 250 points. therefore, for my 12 westin/sheraton stays a year, i will get the equivalent of 3,000 points. this is worth $90. (the rest of my stays are at four points, where they have free wifi for everyone).

- as a platinum, i'll have access to continental breakfast for two as one of my amenity choices, which i don't value very much because i'm not a continental breakfast kind of guy. therefore, i'd take the points instead.

- as a platinum, i have access to the sheraton club lounges where available. sometimes there are great free hot food options during evening hours (sheraton eau claire calgary), usually, it's just free morning breakfast for two. my AAA rate usually gives me free breakfast at the sheratons that i stay at anyway, so this isn't really a benefit to me. the free beverages (i save on buying coffee for two) is probably $5 a night. at 12 sheraton nights a year, that's worth $60.

- total quantifiable benefit: $290, possibly more if i stay at a sheraton that doesn't give me free breakfast with the AAA rate.

- upgrades to best available room, including suites. however, upon check in to the sheraton bellevue just now, they simply put me on a club floor. it's really nothing fancy.

- access to the platinum concierge service, which i apparently can't use unless i'm overseas.

- access to the platinum call center.

i spent $847. i had $90 in savings, i got back $195 in points, and $290 in other quantifiable benefits. this equates to a $272 investment for a year of platinum. it's not as much as my mileage run 3 years ago that earned me star gold status with asiana airlines. the quantifiable benefits of star gold status were clearly worth it. however, we will see whether the qualitative benefits of starwood platinum status is worth it.

Saturday 4 January 2014

links from the web: tied up for wanting a smoke, cibc matching td's travel benefits, amtrak's "go free" promotion

1) a passenger is tied up for repeatedly trying to smoke a cigarette on an emirates long haul flight. oh, i guess he was also tied up for physically assaulting the crew. it was on a singapore-brisbane flight. i can't imagine what would happen if it were on a singapore flight, with their fairly dainty singapore girls. nails would be broken! (flyertalk thread)

2) CIBC is matching some of TD's travel benefits on their aerogold infinite visa. starting january 15, cardholders get priority boarding, priority check in, and first bag free when flying on a reward flight operated by air canada. they will also give you a one-time use lounge pass for use, again only on reward flights operated by air canada.

3) view from the wing points out that amtrak is rolling out their "go free" promotion. essentially, if you take a certain number of round trips on their specific lines, they'll throw in one free (for use during a certain qualifying period). the one that is most valuable to me is the cascade line running between oregon, washington state, and vancouver. if you travel 2 qualifying round trips between january 6 and march 1, 2014, you will get one free round trip to use between march 2, 2014 and april 30, 2014.

2) CIBC is matching some of TD's travel benefits on their aerogold infinite visa. starting january 15, cardholders get priority boarding, priority check in, and first bag free when flying on a reward flight operated by air canada. they will also give you a one-time use lounge pass for use, again only on reward flights operated by air canada.

3) view from the wing points out that amtrak is rolling out their "go free" promotion. essentially, if you take a certain number of round trips on their specific lines, they'll throw in one free (for use during a certain qualifying period). the one that is most valuable to me is the cascade line running between oregon, washington state, and vancouver. if you travel 2 qualifying round trips between january 6 and march 1, 2014, you will get one free round trip to use between march 2, 2014 and april 30, 2014.

- in doing a quick investigation of prices, amtrak is about twice as expensive as the bolt bus. however, amtrak's border clearance process is much better than the bolt bus as you clear and pre-clear at the actual rail station in vancouver.

Thursday 2 January 2014

aeroplan td visa cards -- information now online

earlier today, td announced their 4 new card products:

1) td aeroplan visa infinite privilege card

at 1 point per $1 spend on what will most likely be their most popular card, i'm not completely certain about its value. i wrote about the capital one travel aspire mastercard in my previous post. for an equivalent of a $20 annual fee, you get all of the insurances and a guaranteed 2% return provided that you've redeemed your points for a travel cost greater than $600.

when i booked my almost-all-business class tickets to asia, i calculated a 4.13 cent per mile return. this assumes that you're willing to value the business class ticket at the prices they sell them at. i bet that most people wouldn't. this also assumes that you can find availability, which is never guaranteed. and compared to the capital one mastercard, redeeming for economy class tickets rarely ever makes sense

if comparing to another airline points-based credit card, i would suggest that the starwood preferred guest american express wins. with a 1 starpoint per dollar spent, and with each starpoint being worth 1.25 points in over 25 different airline programs, the starwood preferred guest amex wins. the only downside is its limited acceptance amongst merchants.

alternatively, if one were to try out the capital one delta skymiles world mastercard, you would get 2 skymiles per dollar spent, and 10,000 bonus points after $25,000 in annual spending. if skyteam had a stronger presence in canada, this would also be a much stronger card than these td aeroplan cards.

additional flight benefits

as a star gold member, i already get these benefits. it certainly adds benefits for the occasional flyer flying on rewards. when i first read through the information, i thought that it would give priority boarding and check in to all cardholders flying any air canada flight. thankfully, that is not the case (as it is with credit card holders in the states). it also creates only a very minor dilution in the actual benefits of elite status, which i think will be tolerable enough.

overall

i struggle to find enough value in these aeroplan cards to justify using one of them for my everyday spending. the sign up bonuses, however, may be worthwhile.

1) td aeroplan visa infinite privilege card

- annual fee: $399

- welcome bonus 25,000 pts

- minimum requirements: $200,000 annual household income or $50,000 spend

- 1.5 miles/$ for gas, grocery, drug store purchases

- 1.25 miles/$ for everything else

- complimentary checked bag, priority check-in and boarding, 4 maple leaf lounge passes a year, all applicable to any air canada operated flight

- global airport lounge service -- not fully defined, but only a set number of uses allowed

- out of province medical ($5 million), trip delay/interruption/cancellation, common carrier travel accident, delayed/lost baggage, auto rental LDW insurance

- purchase protection and extended warranty

- annual fee: $120

- welcome bonus 15,000 pts

- minimum requirements: $60,000 annual personal income or $100,000 spend

- 1.5 miles/$ for gas, grocery, drug store purchases

- 1 miles/$ for everything else

- complimentary checked bag, priority check-in and boarding, 4 maple leaf lounge passes a year, all applicable to air canada operated reward flights only

- out of province medical, trip delay/interruption/cancellation, common carrier travel accident, delayed/lost baggage, auto rental LDW insurance

- purchase protection and extended warranty

- annual fee: $89

- welcome bonus 10,000 points

- minimum requirements: $12,000 annual income

- 1 mile/$ for gas, grocery, drug store purchases

- 1 miles/$1.50 for everything else

- trip delay/interruption, common carrier travel accident, delayed/lost baggage, auto rental LDW insurance

- purchase protection and extended warranty

- similar to the infinite, except with an annual fee of $149

at 1 point per $1 spend on what will most likely be their most popular card, i'm not completely certain about its value. i wrote about the capital one travel aspire mastercard in my previous post. for an equivalent of a $20 annual fee, you get all of the insurances and a guaranteed 2% return provided that you've redeemed your points for a travel cost greater than $600.

when i booked my almost-all-business class tickets to asia, i calculated a 4.13 cent per mile return. this assumes that you're willing to value the business class ticket at the prices they sell them at. i bet that most people wouldn't. this also assumes that you can find availability, which is never guaranteed. and compared to the capital one mastercard, redeeming for economy class tickets rarely ever makes sense

if comparing to another airline points-based credit card, i would suggest that the starwood preferred guest american express wins. with a 1 starpoint per dollar spent, and with each starpoint being worth 1.25 points in over 25 different airline programs, the starwood preferred guest amex wins. the only downside is its limited acceptance amongst merchants.

alternatively, if one were to try out the capital one delta skymiles world mastercard, you would get 2 skymiles per dollar spent, and 10,000 bonus points after $25,000 in annual spending. if skyteam had a stronger presence in canada, this would also be a much stronger card than these td aeroplan cards.

additional flight benefits

as a star gold member, i already get these benefits. it certainly adds benefits for the occasional flyer flying on rewards. when i first read through the information, i thought that it would give priority boarding and check in to all cardholders flying any air canada flight. thankfully, that is not the case (as it is with credit card holders in the states). it also creates only a very minor dilution in the actual benefits of elite status, which i think will be tolerable enough.

overall

i struggle to find enough value in these aeroplan cards to justify using one of them for my everyday spending. the sign up bonuses, however, may be worthwhile.

Subscribe to:

Posts (Atom)